GET YOUR FREE ZONE COMPANY

With over 50 free zones in the UAE, how do you have any idea about which one is best for you? Setting up in the right free zone will situate your business for progress.

What is a Free Zone company?

A Free Zone is a specified autonomous jurisdiction area within each Emirate. Free Zones are operated by a regulatory body known as the Free Zone Authority (FZA) and function based on their own regulations.

Free Zones provide a host of competitive packages and benefits—including 100% foreign ownership and an income-tax-free environment—for investors looking to set up their company in the region.

A Free Zone company is any company registered within the 40+ Free Zones of the UAE. This type of company is only authorized to trade within the Free Zone and outside the UAE; this means that a Free Zone company cannot trade on the mainland.

An investor can commonly set up 3 types of business companies within a Free Zone—Free Zone Company (FZC), Free Zone Establishment (FZE) and a Branch of a business concern.

Benefits of setting up a Free Zone company in the UAE

Some of the benefits of setting up a Free Zone company in the UAE have been listed as follows.

Complete expat ownership: Expat investors looking to set up a Free Zone company in the UAE can own 100% of their company. This allows business owners to keep what they earn and even repatriate the profits to their homeland.

No income tax: Free Zone companies are exempt from income tax. In the case of corporate tax, however, the company will be exempt only if the trade is based outside of the UAE or if the total company net profits are less than AED 375,000. This is in line with the recent corporate tax law that subjects companies having net profits over AED 375,000 to a 9% corporate tax.

Import and export duty exemption: Free Zone companies are exempt from import and export duties. This, in turn, helps promote seamless international trade.

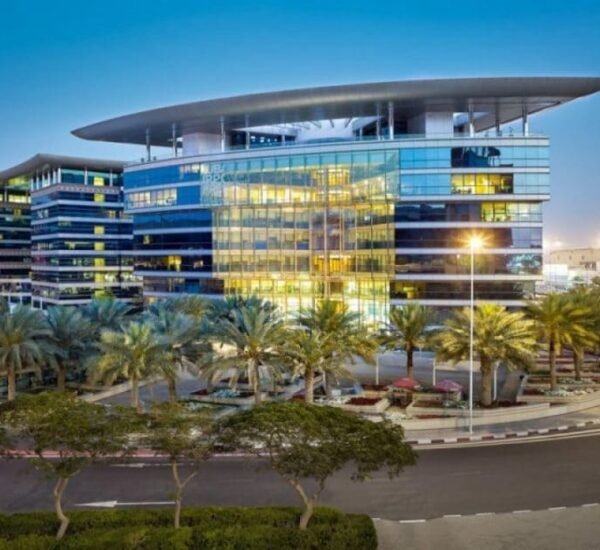

State-of-the-art infrastructure and technology: Free Zones provide state-of-the-art technology and infrastructure that are easily available. Setting up a business can be cost-effective, especially for SMEs and startup companies.

With UAE free zone company formation, you get to enjoy lower levels of regulation than mainland licenses and gain advantages.

-

100% foreign ownership

-

100% repatriation of capital & profits

-

100% exemption from income & corporate taxes

-

100% import & export tax exemption.